Loan Express does not require credit checks, decline a loan based off a credit check, nor do credit checks affect the minimum approved amount of the loan. The following article is purely for educational purposes.

What Is a Bad Credit Score?

Credit scores in Canada range from 300 to 900. The higher your score, the more likely you will get approved for loans and other financing options. Bad credit means a rating below 574, making it challenging to get approved for loans, mortgages, and other financial necessities through major banks.

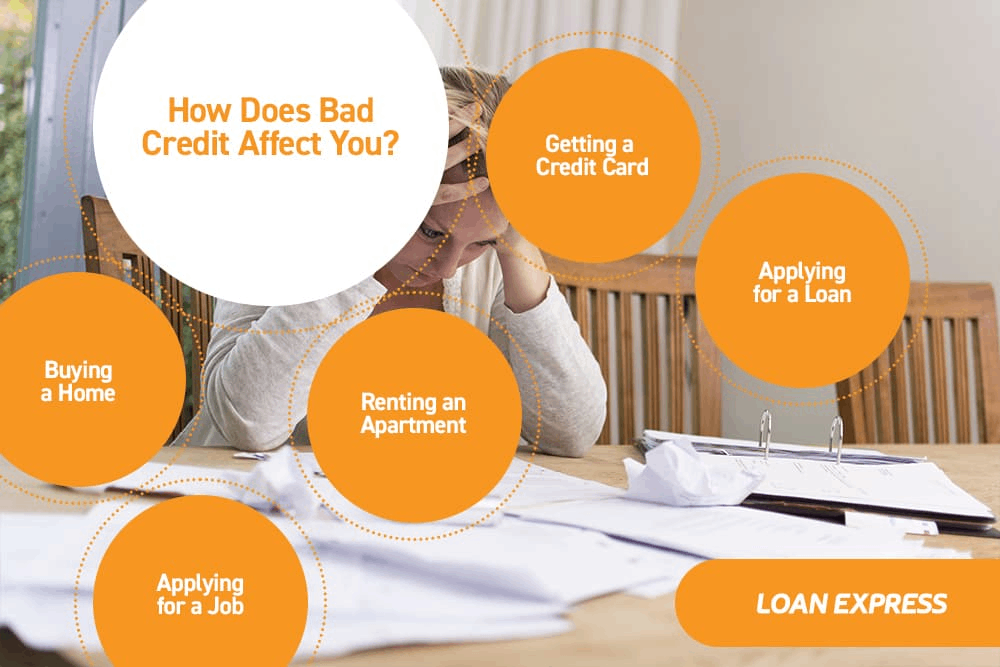

How Does Bad Credit Affect You?

Having a bad credit score makes it tricky to get the best financial products, as lenders will see you as someone who does not honour their payments. They can calculate this score through a credit check done by TransUnion or Equifax. These companies utilize proprietary algorithms to predict how likely you will pay your loan or card on time to calculate your credit score. Below are the top ways bad credit can impact your life.

Getting a Credit Card

A bad credit score can cost you down the line, especially if you’re looking to take advantage of competitive rewards points. A low credit score could mean that your bank won’t give a card with great perks like cash back or low-interest rates.

Applying for a Loan

It will be challenging to get a loan application approved through the major banks with a bad credit score. And if you manage to find one that will approve you, they will likely only offer personal loans or car loans at high-interest rates. Even these may be denied if your debt load exceeds your current income level.

Renting an Apartment

The last thing you want to do is get turned down by a landlord because of your credit score. For example, tenants with bad scores in Toronto are majorly affected, as the average rental application requires an applicant’s credit history and approval usually rests at 650 or higher.

Buying a Home

Because mortgages are ordinarily the most significant loan you will ever take on, they require many risk assessments. Qualifying for a low mortgage rate will be difficult if you have bad credit. Lenders are unlikely to offer mortgages to applicants with bad credit. Even at a high-interest rate, an applicant might want to improve their score before seeking out loans or try finding a guarantor or cosigner.

Applying for a Job

If you are applying for a job in the finance industry, in the civil service, or for a role where you will be in charge of large amounts of money, your credit score can be a key factor in whether or not you get hired for the job. While some employers will ask to see it before hiring you and others won’t, those who do must gain permission from candidates first.

How Do I Improve a Bad Credit Score?

Having bad credit is something that many people struggle with; 3% of Canadians have a credit score below 520. It doesn’t have to be the end of your financial life, and you can work hard and get it back on track if you improve these following financial habits.

Use a Secure Credit Card

Building a history of responsible credit usage is one way to raise and maintain your credit score. If you can’t qualify for a major credit card, then a secured or guaranteed card may be right for you.

Secured credit cards are for those with little or no credit. You can qualify without any prior history, but you’ll need to post a certain amount as collateral – usually equal to the card limit.

As this is not an actual prepaid account (you’re borrowing money and paying interest), your activity will be reported just like it would on other types of loans so that you can build up good credit over time.

Pay Bills on Time

A history of on-time payments is a major factor that TransUnion and Equifax take into account when they calculate your credit score. To help improve your payment habits and ensure that you’re always on time, set up automatic online payments or use phone or calendar reminders, even if you’re making minimum payments.

Monitor Credit Utilization Ratio

Your credit utilization ratio tells you how much debt you have relative to your total limit. Your score drops when this percentage gets too high and can even cause interest rates on loans to go up, so keep it low!

Your credit utilization ratio is the amount of money in debt versus how many dollars are available for borrowing. If there’s more than 33% then be careful about getting any new loans because that may not help your score at all.

Don’t Cancel Old Credit Cards

If you have bad credit, cutting your cards loose or closing down lines of credit may seem like the logical next step to improving it; but don’t do that just yet! Every time you cancel one card (or close an account with available funds), your credit utilization ratio increases as unused and accessible money becomes unavailable. Any positive credit history connected with the card will also be eliminated from your credit report.