Loan Express does not require credit checks, decline a loan based off a credit check, nor do credit checks affect the minimum approved amount of the loan. The following article is purely for educational purposes.

Overview

According to one of Canada’s major credit bureaus, TransUnion, the average credit score in Canada is 650. However, roughly 20% of Canadians have a credit score below 600, making financial decisions considerably tricky.

So, how do you fix it?

You may feel lost, but the first step to repairing bad credit is understanding how long the process will take so you can plan effectively.

How Long Can Bad Credit Stay on Your Credit Report?

The amount of time it will take to repair your credit score depends on what kinds of marks are on your report. This could be one of the many factors that impact your credit scores, such as collection or charged-off accounts, late payments, bankruptcy public records and repossessions.

While it can take a couple of hours to review your credit report thoroughly, finding an error can be sent to credit bureaus to be disputed.

For example, you may see a mark on your report that you didn’t make a payment when, in fact, you did. If you submit your dispute, there is a 30-day period that allows for the bureaus to contact any necessary creditors to verify the claim.

If there are no errors on your credit report, but you have unfavourable marks, it can take up to six months to start rebuilding your credit score. Negative information such as late payments, accounts sent to collections, accounts not being paid by the agreed-upon terms, or bankruptcies stay on credit reports for roughly seven years.

How Long Do Collections Stay on a Credit Report?

If you have an amount owing that you haven’t paid off for over six months (think phone bill or credit card statement), the creditor has the right to close your account and sell it to a collections agency.

Once your debt information has been sold, the number “9” will appear next to that loan on your credit report, signalling others that you have been sent to a collection agency. This can stay on your credit report for up to seven years and lower your overall score by 20-50 points. In this case, it’s essential to begin the process of repayment. Contact the collections agency for the next steps and inquire about the possibility of a payment plan.

How Long Does Bankruptcy Stay on Your Credit Report in Canada

Once filed, it will stay on your credit report for up to seven years. If you file for bankruptcy twice, it can stay on your credit report for up to 14 years. This is not an easy way out of debt. Anyone who is considering bankruptcy should speak with a financial expert for alternatives.

How to Get Negative Items Out of Your Credit Score

Whether you’re applying for a form of revolving or installment credit, loan providers will request a copy of your credit report. It’s not uncommon for a credit report to include some errors, which is why you should check yours at least every year. This is the first step of eliminating wrongful marks on your credit history!

If you are attempting to remove marks such as a late payment or a paid collection that remains on your credit report after repayment, write a letter of goodwill to the credit agencies asking for its removal.

If disputation of wrongful marks or a letter of goodwill does not work, negotiating a payment to the creditors to delete the marks is an alternative option.

How Do Credit Checks Impact Your Credit? Hard Inquiries Vs Soft Inquiries

Lenders will base approval rates for a loan on the applicant’s financial history by assessing your credit score through a credit check. These monetary inquiries can be made before applying for things like credit cards, auto loans, or mortgages. There are two types of credit checks, and depending on the type, they can also affect your credit score.

Soft inquiries or “soft pulls”

Soft credit inquiries happen when your credit report is checked for informational purposes. This type of credit check will not show up on your credit report to other lenders and will not impact your score. These typically happen if you are pre-qualified for a credit card, an employee background check, or when your bank looks at your credit report to determine your overall financial health.

Hard inquiries or “hard pulls”

Hard inquiries are made when you apply for a substantial loan such as a mortgage, credit card, personal loan, student loan or an apartment rental application. One single hard inquiry won’t typically impact your credit score negatively; however, they will stay on your report for up to two years. Your credit score can lower if you have several individual hard pulls recorded on your credit file within a short period.

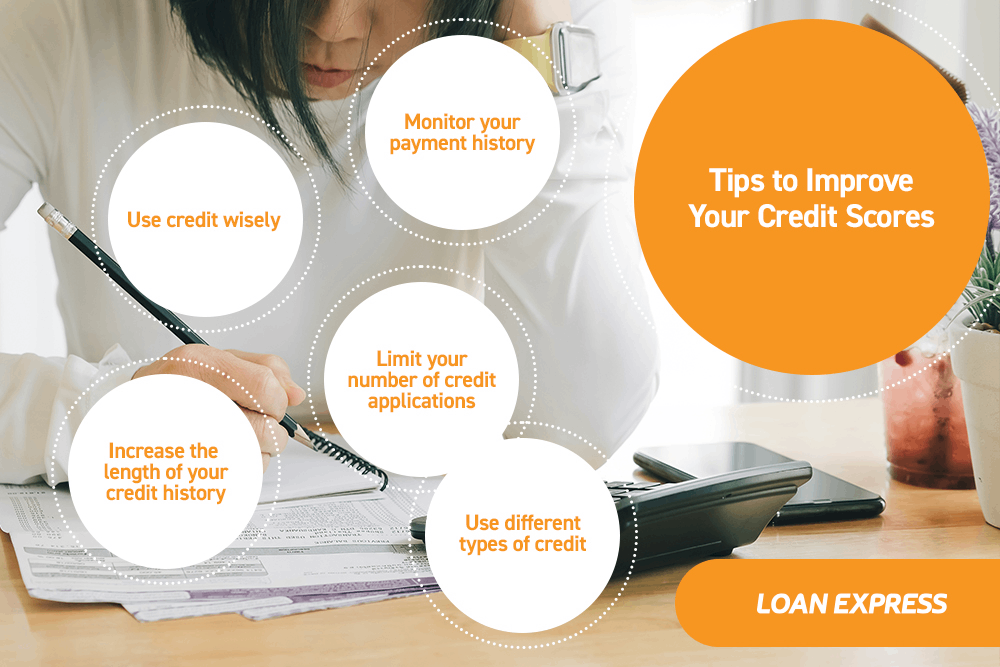

Tips to Improve Your Credit Scores

To improve your credit score, follow these tips as laid out by the Financial Consumer Agency of Canada:

- Monitor your payment history: don’t miss payments, and monitor your credit score

- Use credit wisely: Don’t go over your credit limit – even if you use a lot of your available credit and pay your bills on time, lenders see you as a greater risk.

- Increase the length of your credit history: The longer you have a credit account open and in use, the better it is for your score. Try to keep your oldest credit card actively used and paid off.

- Limit your number of credit applications or credit checks: limit the number of times you apply for credit, and do so only when you need it.

- Use different types of credit: A mix of credit products (that are paid in full on time), such as a credit card, car loan, and a line of credit, may improve your credit score.

Want to Apply for Loan Without A Credit Check? Visit Loan Express Today!

When it comes to applying for a loan with Loan Express, good credit or bad credit makes no difference. We will never reject an application based on credit history or a credit score! Receive the cash you need with peace of mind today, with Loan Express.

Disclosure

Total cost of borrowing is $14.00 per $100 lent for a 14-day loan.

Payday Loans are High-Cost Loans.

- BC Licence #50028

- AB Licence #327001

- SK Licence #100056

- MB Licence #39281 (Exp. Oct 18, 2026)

- ON Licence #4716499

- NB Licence #200001546

- NS Licence #202645507

- NL Licence #20-23-LO073-1