Loan Express does not require credit checks, decline a loan based off a credit check, nor do credit checks affect the minimum approved amount of the loan. The following article is purely for educational purposes.

Overview:

You may be surprised to hear that you don’t have just one credit score. The amount will vary from score providers, data on which the score is based, and the calculation method. Credit scores provided by the major credit bureaus, Equifax, Experian, and TransUnion, can vary.

This is because not all lenders report information to every one of these agencies; some creditors only communicate with two or less!

The types of credit scores used by lenders can also vary based on their industry. For example, auto lenders might use a score that emphasizes your payment history when it comes to deciding whether or not you’re eligible for an auto loan. Other financial institutions would take into account the spectrum of information from all three major credit bureaus before lending money.

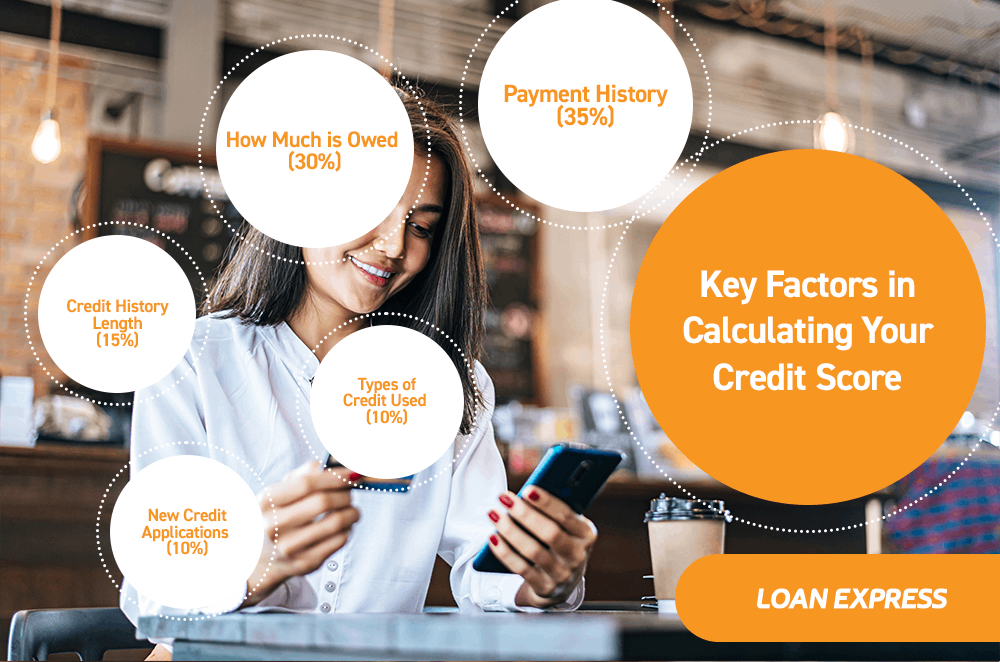

Key Factors in Calculating Your Credit Score

There are many factors considered in the calculations. Still, they all have different weights depending on what scoring model is being used at any given time. A credit score determines your trustworthiness in paying debts such as car payments, mortgages, taxes – anything with lending backing. The calculation includes various aspects from income levels and debt ratios down to bankruptcy history.

Payment History (35%)

One of the most important factors a lender will look at when deciding whether or not to lend you money is your payment history. They want to know if they can count on you repaying them in full by their specified due date. This is why it’s so important that every bill is paid as soon as possible.

Your credit report includes all past records of how well you’ve repaid creditors before – including things like installment loans, retail accounts with department stores, and auto loans for cars. A lender will also look for:

- Late payments

- Amount of accounts that go unpaid at the same time

- Bankruptcies

- Foreclosures

- Wage attachments

- Accounts that have been reported to collections

How Much is Owed (30%)

When applying for credit from lenders, their approval also largely depends on whether or not you have too many debts. If you cannot manage any more charges within your budget, they may not approve your application. These defaults in payment and potential future payments with another loan added into the mix can show this likelihood and raise alarms within risk calculations.

Suppose you usually use 60% or more of your credit limit on a credit card or line of credit. In that case, it will negatively affect your score. If a lender checks out how much debt you owe against what is left in credit limits, they would see that there isn’t enough upfront cash coming from future repayments.

Credit History Length (15%)

Suppose you have had credit available to you for a long time. In that case, your credit report should provide an accurate picture of how responsible and reliable someone is with their finances. A person who has not been using any form of finance may be seen as struggling financially because they cannot make ends meet on what little money they get each month.

To keep a c, someone has to use their credit card minimally and consistently. Good or bad information will be removed automatically after 6-7 years of no activity on the account.

If you are new to using credit responsibly for the first time or if it has been many years since last used, then there is some catching up that needs to be done before achieving a good credit score.

Types of Credit Used (10%)

Different types of credit shed light on your approach to handling money. For example, deferred interest or payment plans can indicate that you cannot save up for purchases ahead of time and may be more likely to spend impulsively. Focus on maintaining your finances carefully and only apply for credit as you need it. If you can do that, this smaller part of your score should take care of itself!

New Credit Applications (10%)

People who are constantly applying for new credit can be viewed as a red flag in the industry. Credit shopping is not something that reflects favourably on someone’s credit score. Creditors have reason to worry about how much of their available funds will go towards paying off these debts when they need them elsewhere (e.g., living expenses).

Other Factors

Multiple factors go into your credit score, and how lenders interpret this information can vary between companies. When you’re applying for credit, lenders will also consider:

- Your income

- Your assets

- How long you have been at your job

- Why you are applying for credit

Why is Your Credit Score Important?

Your credit report and score matter because lenders want to know how you have handled your finances in the past. Lenders will use that information and other criteria such as employment history or income potential when deciding what they are willing to lend someone at a given interest rate. The better your credit score, the easier it will be to get a mortgage, lower interest rates on loans and can even affect apartment applications or job prospects! Try to check your credit score through a soft inquiry at least once a year, this will help you to identify areas that you can improve on.

Disclosure

Total cost of borrowing is $14.00 per $100 lent for a 14-day loan.

Payday Loans are High-Cost Loans.

- BC Licence #50028

- AB Licence #327001

- SK Licence #100056

- MB Licence #39281 (Exp. Oct 18, 2026)

- ON Licence #4716499

- NB Licence #200001546

- NS Licence #202645507

- NL Licence #20-23-LO073-1